Exactly how Was Tx USDA Money Computed?

Texas USDA Loans was determined according to estimated money computed because of the the lenders toward following 1 year. The maximum amount borrowed formula is performed considering all of the offered historical analysis, plus it is sold with the modern pay stubs including W2s. However, this new USDA keeps put the income restrict, and loans in Lexington it is calculated ahead of deductions are made of the newest payroll. Revenues is simply an expression of any bonuses, salary, info, fee, overtime, as well as service payment; additionally, it may were lifestyle allowances cost or even the houses allowance obtained.

If you live in this children where an associate was an effective farmer otherwise they own a company, there’s now the effective use of net gain regarding procedures. At exactly the same time, lenders have their unique specific assistance and this revolve as much as a position and you may money.

All the loans are at the mercy of underwriting or buyer acceptance. Almost every other constraints can get apply. This isn’t an offer off credit otherwise a relationship to provide. Assistance and you will items are susceptible to alter.

The fresh USDA Loan Acceptance Techniques to possess an effective USDA loan when you look at the Texas starts with getting in touch with an approved USDA Financing Individual Bank. Acknowledged USDA Financing Private Lenders are backed by the us Institution of Agriculture but don’t actually offer you the house loan by themselves.

Do you know the Great things about A texas USDA Mortgage?

The main benefit of a colorado USDA Mortgage is getting closed to the a thirty-year financial having the lowest repaired interest rate and you will potentially zero advance payment demands. Without having a deposit, you will have to spend a premium to own mortgage insurance coverage so you can decrease the new lender’s chance.

Texas USDA mortgage positives and negatives

Secondly, no money reserves are essential. This will help to you purchase property faster without having a great deal of cash saved up from the financial.

The financing and qualifying guidance are versatile, which also makes it easier to qualify for financial support, whether or not your credit report, report, and you will scores is actually as better while they want be getting traditional otherwise commercial financial support.

Other brighten from the system is the fact it could be put upwards therefore, the supplier pays the fresh new settlement costs. The possible lack of prepayment punishment and low repaired rates of interest was several even more has actually one to save some costs. You can even make use of this loan to invest in settlement costs and fixes straight into the mortgage.

The entire self-reliance of your own program can be so versatile that you may use this to own strengthening a home, to acquire a home, if you don’t merely refinancing that. The applying facilitate Agricultural Firms that have Performing Fund to assist finance Farming Surgery. These types of Working Funds lend recommendations having farmers to access quality areas.

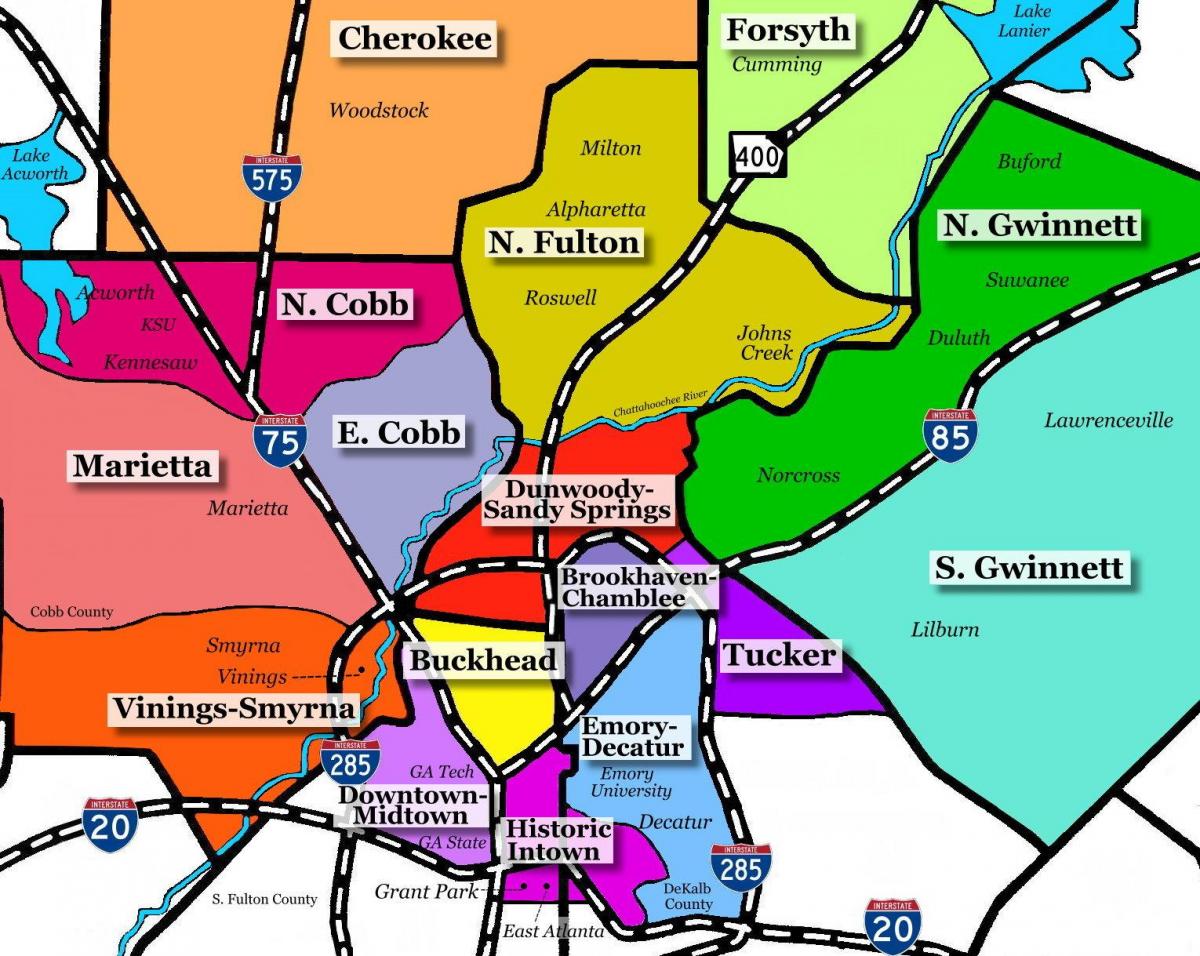

For starters, you’ll find geographical limitations. While many Texans qualify towards program, it is established a lot more into the rural and you will residential district homes, thus those residing extremely towns may not meet the requirements. Luckily for us, you’ll find online resources where you are able to simply plug on physical address of every belongings to choose more than likely qualifications.

Secondly, you can find income constraints. For people who otherwise your household produces excess amount in excess of system hats, you might not be eligible for recommendations otherwise positives.

3rd, mortgage insurance is always included in the financing. At the same time, it’s good to have that publicity, and you will actually necessary to start by. However, pressed addition for the loan might stop you from shopping around for your own personal insurer of preference.

4th lastly, that it loan and system don’t be eligible for duplex house. Appropriate residences can only just feel unmarried-household members units. Plus, they must be proprietor-occupied, and that means you are unable to make use of these gurus having flips, renting, otherwise vacation land.