According to that which you come across on tv reveals, to acquire a fixer-upper appears to be ways to create a lot of dollars with a bit of earliest Diy. Regrettably, the truth is a little different. For the one hand, fixer-top house can be hugely sensible and you can a solid financing. On the other, they may be able also ver quickly become money pits.

You desire a good Finances

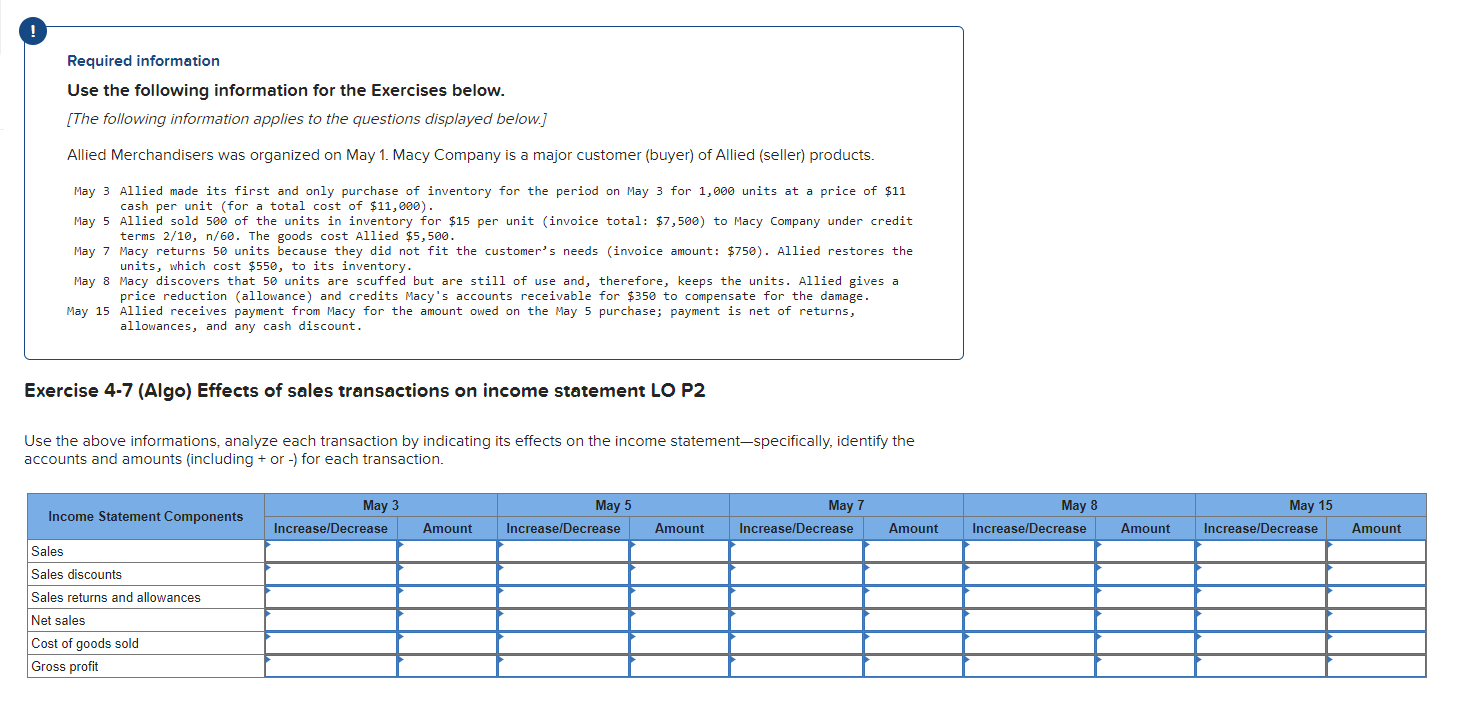

Like any a house deal, to acquire a beneficial fixer-upper need doing an environment-tight budget. Before you even start appearing, you must know what you are able afford. Instead of a routine a property purchase, however, your financial budget must reason behind the cost of fixes, as well as the house’s price tag, closing costs and all of those people almost every other undetectable costs.

After you would a budget for a great fixer-top, you need a company profile at heart your prepared to devote to your panels. Definitely create a supplementary fifteen% because the even the most useful-laid agreements dont constantly pan out. With this specific shape in your mind, you are top placed to determine just what amount of home improvements your are able, that can determine the most suitable property for your requirements.

You’ve got Certain Resource Solutions

When you’re we are these are costs, it is value with the knowledge that in both Canada together with You.S., you can sign up for a different home loan aimed at fixer-uppers. Throughout the U.S., you have the pursuing the options:

- Federal national mortgage association HomeStyle Financing: Finance to have renovations get into a keen escrow account to blow builders; an excellent 5% down payment is needed; all the way down interest levels than just HELOC; can be used for top and you can vacation land, including financing qualities.

- Freddie Mac’s CHOICERenovation Mortgage: An excellent 5% down payment needs; all the way down interest rates than simply HELOC; are used for no. 1 and vacation house, as well as resource qualities.

- FHA 203(k) loan: The price of remodeling and buying the house was rolled on the one to loan; all the way down credit history needs versus a traditional loan.

- Virtual assistant restoration mortgage: The cost of renovating and buying our home is actually folded toward one loan; need to have fun with an excellent Virtual assistant-acknowledged specialist.

At the same time, during the Canada, you’re qualified to receive a repair home loan, and this is sold with all the way down rates and an extended amortization period having down costs.

You’ll have the home Carefully Inspected

It’s always best that you get potential new home examined by the a home inspector, but with a good fixer-higher, it’s crucial. Actually, you will find several formal monitors that are well worth investing a small much more about to be sure you’re not to shop for a house having extreme issues.

- Pest monitors: Essential in parts that have pest, ant otherwise beetle dilemmas.

- Rooftop certifications: Will bring proof of age and standing of your rooftop.

- Sewage checks: Aging septic tanks and you can sewage outlines can cost a lot to change.

- Systems statement: Reveals people current otherwise prospective absolute or geological threats.

Additionally, make sure to has actually fundamentals, Heating and cooling http://www.availableloan.net/installment-loans-wi/kingston possibilities and you can electronic possibilities very carefully appeared, because these is extremely expensive and you may date-taking to fix. In the event the discover circumstances, they could be perhaps not worth the costs or energy to resolve, so be sure to build your promote contingent into the effect ones some inspections.

You want plans

You’ll want to thought ahead when selecting an excellent fixer-top, and you can a good plan helps you to save loads of fret. Such as for example, simply how much of the work are you willing to create on your own? Do you really manage to hire builders to own big operate? Do you actually live on-webpages while in the renovations? Ask such concerns, as well as if you plan and also make that it their forever household, bundle as if you are promoting in the future. And don’t forget to policy for delays as well, as these include regular inside the design tactics.

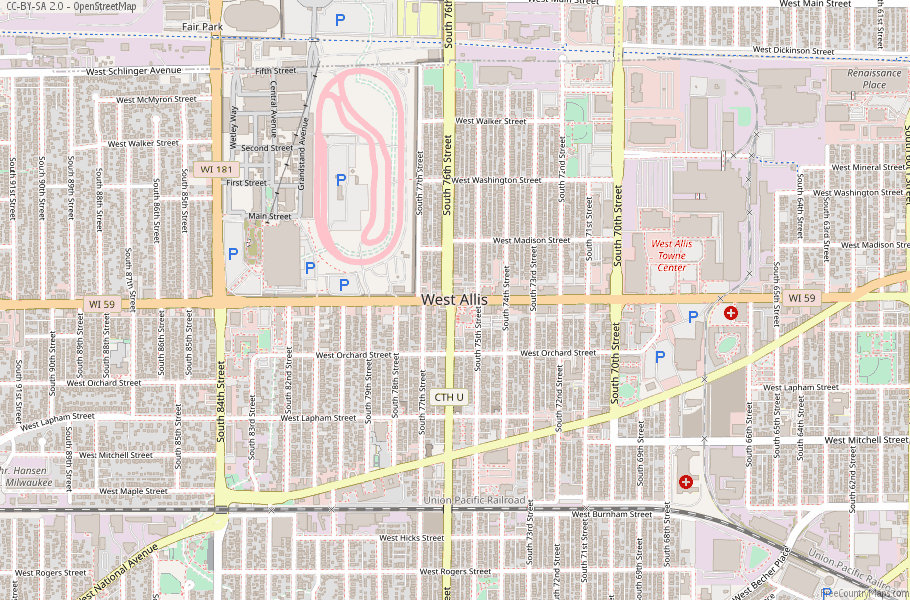

Place is key

No matter how incredible you make your residence, you could never ever change their place. Therefore think about, intend to offer. Good house in a detrimental neighborhood, otherwise next to noisy, pungent otherwise unattractive amenities, commonly struggle to promote. Specific good advice is to purchase the fresh worst domestic into top road. A fixer-upper are going to be a great way to enter into your dream society at a reasonable cost.